Tax Department

As of January 1, 2025

Per the State of Ohio ORC 718.05 - It is MANDATORY that you provide a copy of your Federal 1040

with your Deer Park return, in addtion to the items listed below.

If you don't have a copy of your Federal 1040, your Deer Park return will NOT be filed/completed.

The due date for filing your tax return is April 15th.

** For IN-PERSON tax appointments - We cannot accept digital copies (phone, laptop, etc).

You MUST provide paper copies to our office. **

Items required for filing your Deer Park tax return~

All copies of W-2s.

All W-2Gs - Gambling winnings.

FEDERAL 1040 - This is your Federal tax filing that's prepared via TurboTax, HR Block, accountant, etc.

Schedule 1 - Attached to Federal 1040.

Schedule C - If you own a business.

Schedule E - If you own rental properties.

1099-MISC - If you have one.

1099-NEC - If you have one.

*** DO NOT STAPLE OR PAPERCLIP FORMS, DOCUMENTS, CHECKS, ETC. ***

All residents are required to file a Deer Park income tax return regardless of whether tax is owed or not, and regardless of whether or not a Federal or State return was filed.

If you need assistance with your return -

- Submit your documents (W-2s, W-Gs, 1099's, Federal Form 1040, Schedule C or E) and we’ll prepare your return for you. You can mail your documents, upload them electronically to the secure email link , or put them in the physical drop box at the municipal building (there is one outside by parking lot and one inside ). Be sure to include contact information with your documents so that we may call or email you with questions.

- All residents now have the ability to e-file your tax return. Using the e-file link, the program walks you through entering your information and uploading your documentation. Click submit and you are done. If this will be the first return you file with the City of Deer Park, you must first set up an account by contacting the Tax Office. If you have filed a return in the past, you already have an account and can access the e-file link now. YOU SET YOUR OWN PIN. If you forget your PIN, you can reset it.

- PLEASE NOTE: If you have not filed with us previously, you will not be able to e-file. Due to the high volume of returns during tax season, if you are unable to e-file, please send your information through the secure email link or via one of the other options stated above, and we will complete your return for you.

- If you owe taxes you can pay those online with our secure payment link.

- If you would like us to prepare your return while you wait, schedule an appointment by calling our office at 513-794-8863 during business hours (8:00 AM - 4:30 PM). Appointments are available Monday through Friday from 8:15am - 4:00pm. NOTE--YOU MUST HAVE AN APPOINTMENT. Walk-in service is NOT available.

City of Deer Park Tax Office

Address: 7777 Blue Ash Road

Deer Park, OH 45236

Phone: 513.794.8863

Fax: 513.794.8866

Tax Administrator: Sheena Johnson

Tax Clerk: Julie Hoffman - jhoffman@deerpark-oh.gov

Appointments available between the hours of: 8:15am - 4:00pm, Monday - Friday.

For ONLINE Credit Card payments: CLICK HERE TO MAKE ONLINE TAX PAYMENTS

You can now E-FILE with the City of Deer Park www.mitstaxonline.com/deerpark

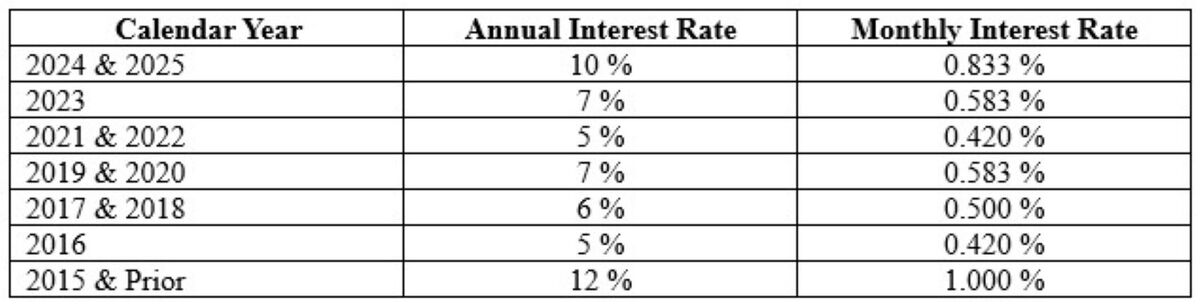

Annual Interest Rates -

By October 31 of each year, the interest rate that will apply to overdue municipal income taxes during the next calendar year will be posted here, as required by Ohio Revised Code Section 718.27(F).

In accordance with ORC Section 718.27(A)(5), applicable to tax years beginning on or after January 1, 2016, the applicable interest rates are as follows:

When to File:

IT IS MANDATORY TO FILE A DEER PARK INCOME TAX RETURN EVEN IF NO TAX IS DUE.

Individual Returns - On or before April 15th.

Business Returns - On or before April 15th, or the 15th day of the 4th month following the end of fiscal year.

Withholding Reconciliations - On or before February 28th.

- If you are in need of forms or have any questions regarding the filing of the annual City of Deer Park income tax return, please feel free to call or obtain forms and information on our website.

- The City of Deer Park Tax Office will assist with the completion of your individual Deer Park tax return. Make an appointment and bring all W-2(s), 1099s, your Federal 1040 and all Federal Schedules reporting income.

For in-person appointments, you must bring paper copies. We cannot accept digital copies (phone, laptop, etc).